As demonstrated by the uselessness of the UNHCR card, RP stresses that the central problem is not identity per se, as being recognized as Rohingya is simply a way of giving a name to their continuous omission from society. Rather, any identity project must be instrumental in materially altering life opportunities.

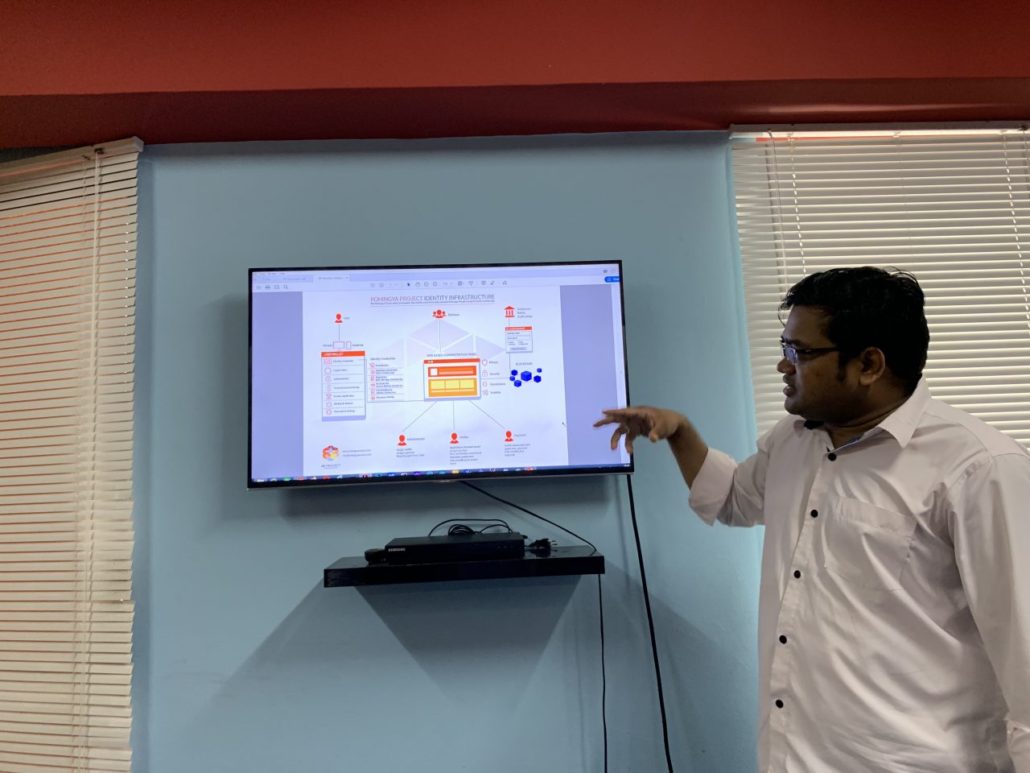

As Noor suggests above, one way to achieve such a transformation is to allow the stateless to obtain bank accounts. But post-9/11 revisions to international financial law, in which financial flows have been securitized to prevent ‘material support’ to what dominant states perceive are malignant actors, have meant that the stateless often cannot access bank accounts. This is because as knowledge about the recipients of finance has been intensified, expressed in so-called “Know Your Customer” (KYC) protocols, banks comply by simply relying on state knowledge apparatuses (citizenship identification). Those without ID, such as the stateless, are effectively barred. However, as a University of Washington study for RP shows, the statutes make an exception when individual’s biometric data—an encrypted iris scan, for instance—can be used to confirm their identity. This is where blockchain comes in.

Blockchain operates as a ledger sequentially recording transactions, block by block, as it were. But whereas centralized ledgers sequester information within virtual walls, blockchain’s architecture turns the structure inside-out, distributing data across the potentially infinite nodes composing the network. The entire chain—every transaction—is replicated on every node, constituting a horizontal system that has no center to hack. Proponents hence argue that blockchained data are impregnable and immutable—as any single violated node would, by dint of its incongruity with the rest, be identified and rejected.